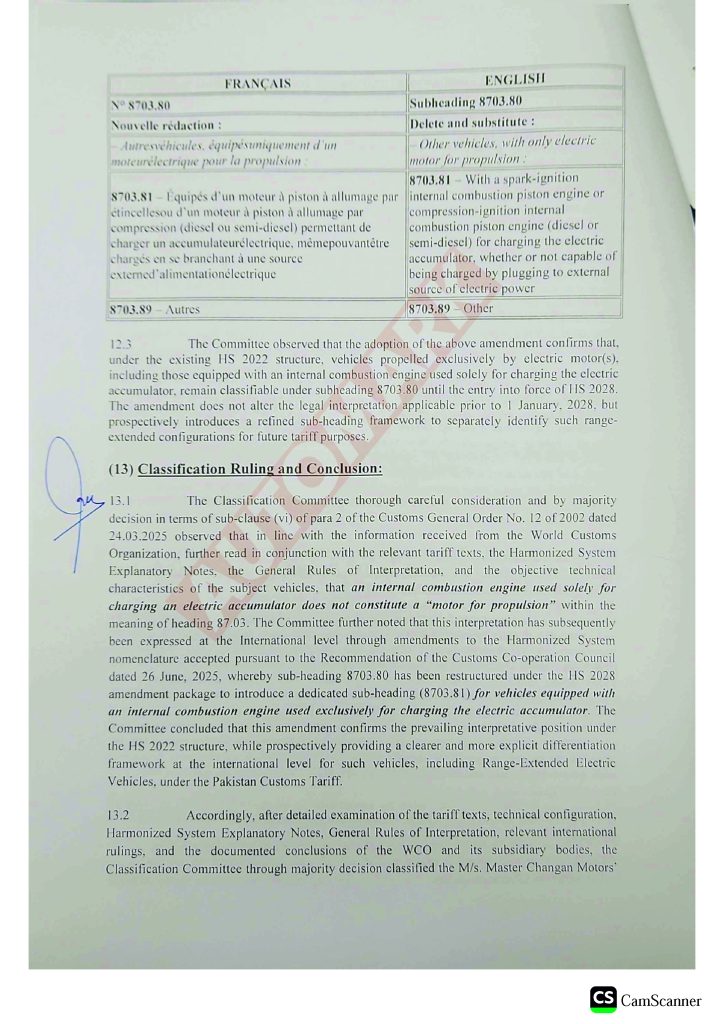

As we conclude a year of significant operational milestones and navigate the complexities of a transitioning market, I wish all automotive professionals, stakeholders, and the distinguished members of the Automark community a prosperous and impactful 2026. The coming year represents a pivotal chapter for Pakistan’s automotive landscape. As we align with global shifts toward electric mobility and sustainable manufacturing, our focus remains steadfast on resilience, localization, and operational excellence. In 2026, the promise of the “Symphony of Production” becomes more relevant than ever. We are moving beyond traditional assembly toward a future.

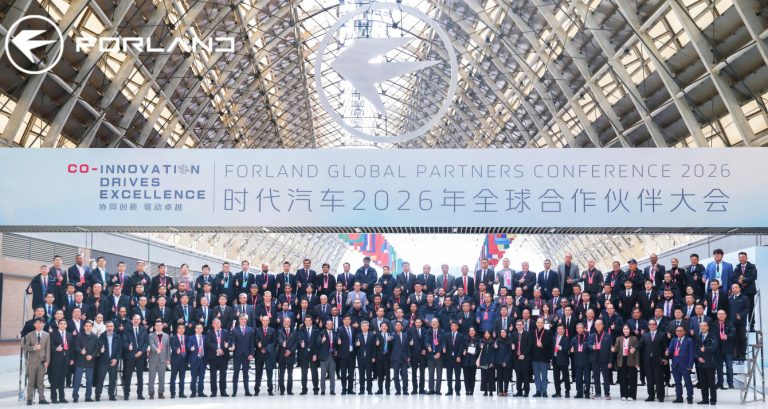

In November 2025, industry elites, partners, and visionaries met in Qingdao, China, for the FORLAND Global Partners Conference 2026. The event was an occasion that was more than just an industry meet-up—a defining moment for the global commercial vehicle industry, shaped by green transformation, intelligent mobility, and an even deeper level of international collaboration. As the sector presently stands at the crossroads of sustainability and technological revolution, the FORLAND message was loud and clear – namely that the future of commercial transport shall not be made in isolation, but built together.

A Global Industry Entering a New Era

The most significant transformation of the commercial vehicle industry in decades is sweeping the world. Low-carbon development, electrification, and smart driving systems have become not a choice but an imperative competence in competition. According to the industrial data provided by China’s automotive authority, the nation’s exports of commercial vehicles have ranked among the highest worldwide for five consecutive years, while new energy commercial vehicles have taken up more than 18% of the world market in 2025. But beyond the figures, a more profound dynamic is at play. Global markets are shifting from trial adoption to large-scale deployment in the area of green commercial vehicles. Competition is no longer price-driven; it increasingly hinges on compliance, the strength of the ecosystem, localized service, and brand trust. In this arena, Chinese manufacturers are speeding up their international strategies, and FORLAND has become one of the most visible leaders of this transition.

From “Made in China” to “Made for the World”

The road taken by FORLAND reflects the development track of China’s commercial vehicle industry. Founded in 1999, the company grew rapidly to become a domestic sales leader before taking its first steps into overseas markets in 2008. What began as product exports gradually evolved into a more comprehensive global presence. After 26 years of development, FORLAND now serves over 6.8 million users worldwide. Its product lineup has evolved from pure fuel to pure electric, hybrid, and hydrogen-powered models, transforming its business growth from scale-oriented to innovation-driven. In 2024, the establishment of FORLAND’s Global Business Division marked another strategic milestone in speeding up its transformation from an exporter into a globally integrated operator. This evolution was summed up at the conference in one simple yet powerful phrase: global success today is not about selling vehicles abroad—it is about building capabilities abroad.

Technology, Brand, and Ecosystem as Growth Engines

FORLAND’s product lineup, which includes a wide variety of vans, mini trucks, light trucks, and construction vehicles serving the needs of modern logistics and operations, is diverse and flexible enough to meet most global strategies. But vehicles alone are just part of the equation. Now, significant investment is put into new energy technology, autonomous driving, intelligent connectivity, and low-altitude logistics. Meanwhile, FORLAND continues to construct a global supply chain, digital marketing network, and localized service system to support sustainable international growth in depth. This ambition is reflected in the company’s long-term roadmap. In the near term, it focuses on strengthening overseas R&D and local operations. Over the decade to come, FORLAND is set to be a leading global light commercial vehicle brand serving customers in more than 150 countries and regions, reaching 10 million users worldwide, and realizing an annual revenue of about 40 billion Yuan. Backed by this vision, FORLAND introduced its refreshed brand message: “Forland, For You!”-anchored in five core values, namely speed, reliability, quality, freedom of use, and future-oriented innovation. Guided by these values, FORLAND develops its products and builds relationships with partners in markets all around the world.

A Structured Path to Globalization

One of the greatly discussed topics at the conference was the presentation of the model of globalization that FORLAND has been adopting. Unlike many other organizations that were growing at a rapid pace and without depth, FORLAND was adopting a structured plan. The first phase involves laying strong trade roots in terms of car exports and CKD exports. This is followed by localization, encouraging regional manufacturing, marketing, and servicing capabilities. The final phase is more about deepening their integration and setting up their R&D, financial, production, and servicing systems in those markets to create a complete ecosystem. This approach is a reflection of the industry trend: to be globally competitive, it is necessary to possess a strong ecosystem, while products mean little to nothing anymore. In this regard, the company’s strategy puts partners at the forefront of its ecosystem, turning them from distributors to co-creators.

New Products Shaping Global Markets

Product innovation continued to be one of the central highlights of the conference. FORLAND showcased, for the first time, two major offerings in international markets: the L7 Automatic Transmission Truck and the U7 series, together with its latest autonomous driving technologies. Constructed from insight into millions of kilometers of real-world data on global roads, the L7 automatic truck has been upgraded in every aspect: intelligence, power, safety, fuel efficiency, comfort, load capacity, and service support. The L7, a smart light truck designed for extreme environmental conditions ranging from high altitude to sub-zero temperatures, meets the growing need for intelligent automatic transmission products in global light truck markets. The U7 represents another leap forward. Built on an advanced skateboard chassis, it’s the first van in the world to apply cross-domain VICU control technology, which merges power and thermal management systems. Such a design will further enhance its efficiency, flexibility, and adaptability to varied regional needs. Together, these products demonstrate FORLAND’s ability to combine global demand insights with localized technical adaptation—an increasingly necessary capability in international markets.

Experiencing Intelligent Manufacturing Firsthand

In addition to conference environments and speeches, the FORLAND partners were given the opportunity for an immersion experience in the capabilities of FORLAND manufacturing. Tours of the Global Manufacturing Center showed the extent to which intelligent manufacturing has risen to the status of a key element of quality. The presence of highly automated welding shops, precision assembly machines, VIN-based digital quality management, and process monitoring in the exhibition showcased the fulfillment of “Created in China” and turned it from a slogan into a reality. The presence of such machines in the show assured efficiency, and they provide a long-term reliability requirement in the global markets. Test drive experiences also helped to confirm these observations. Ranging from fuel to electric versions, from mini-trucks to light commercial vehicles, partners got to feel in their own bodies how designs, comforts, safety, and intelligent systems mean in practice.

From Products to Platforms

A recurring theme throughout the conference was FORLAND’s shift from product export to platform building. The company is developing full-lifecycle ecosystem models that integrate connected vehicles, financial solutions, energy and recharging platforms, and intelligent services. This platform mindset reflects a broader change in global competition. Success is no longer defined by individual sales but by the ability to support customers throughout the vehicle lifecycle—reducing operational costs, improving uptime, and enabling sustainable growth. By relocating R&D, parts supply, finance, and manufacturing closer to key markets, FORLAND is building resilience while strengthening local partnerships and brand recognition.

A Shared Vision for the Road Ahead: Conclusion of the conference aside, a clear takeaway was that the future of commercial vehicles will be greener, smarter, and more collaborative. FORLAND’s path, from a domestic giant to a builder of ecosystems, is a reflection of Chinese commercial vehicle brands reshaping their position on the globe. With almost three decades of expertise, a defined strategic roadmap, and increasing support across the world, FORLAND not only finds itself at the forefront of the change occurring in the industry, but is, in fact, influencing the course of this transformation. “Made in China” to “Created with the World”—the story of FORLAND illustrates this paradigm shift in the manufacturing and mobility world. This saga of innovation, localization, and collaboration remains an on-going process in the industry’s move towards a sustainable and interconnected future.

This exclusive article has been published in Automark’s January-2026 printed edition. Written by @muhammad-rafique